Business Insurance in and around Defiance

Looking for small business insurance coverage?

Almost 100 years of helping small businesses

Help Protect Your Business With State Farm.

Though you work so hard to ensure otherwise, it is good to recognize that some things are simply out of your control. Accidents happen, like a customer stumbles and falls on your property.

Looking for small business insurance coverage?

Almost 100 years of helping small businesses

Protect Your Business With State Farm

Planning is essential for every business. Since even your brightest plans can't predict product availability or consumer demand. In business, you can be certain of one thing: nothing is certain. That’s why it makes good sense to plan for the unexpected with a State Farm small business policy. Business insurance covers your business from all kinds of mishaps and troubles.. It protects your future with coverage like errors and omissions liability and business continuity plans. Fantastic coverage like this is why Defiance business owners choose State Farm insurance. State Farm agent Doug Nicola can help design a policy for the level of coverage you have in mind. If troubles find you, Doug Nicola can be there to help you file your claim and help your business life go right again.

So, take the responsible next step for your business and visit with State Farm agent Doug Nicola to explore your small business insurance options!

Simple Insights®

Small business benefits to offer

Small business benefits to offer

Benefits are a crucial part of a compensation package. Let’s take a look at some common small business benefits packages.

Consider a Simplified Employee Pension plan for your small business

Consider a Simplified Employee Pension plan for your small business

Simplified Employee Pension IRA (SEP IRA) plans are employee IRAs funded by tax-deductible contributions from small business employers.

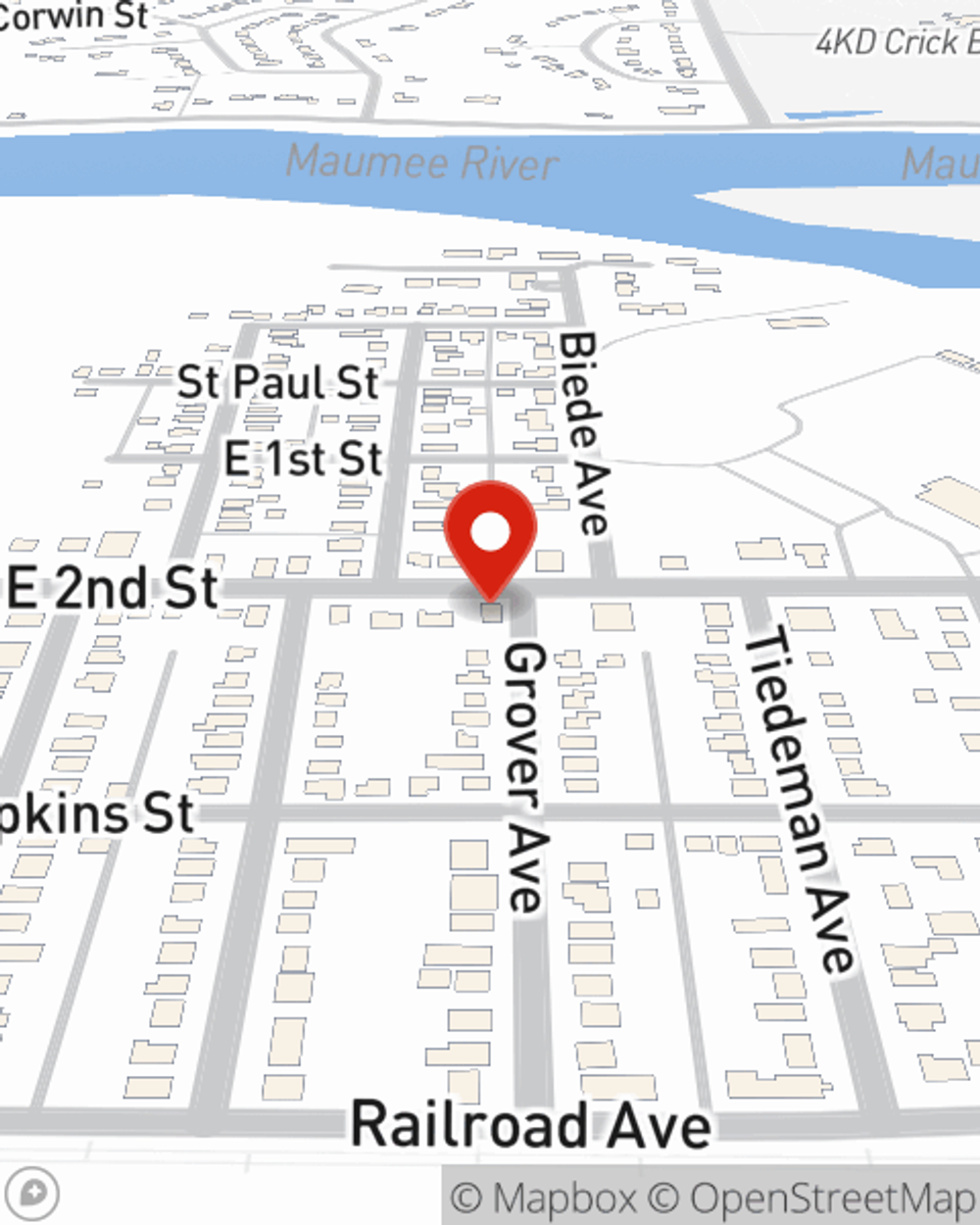

Doug Nicola

State Farm® Insurance AgentSimple Insights®

Small business benefits to offer

Small business benefits to offer

Benefits are a crucial part of a compensation package. Let’s take a look at some common small business benefits packages.

Consider a Simplified Employee Pension plan for your small business

Consider a Simplified Employee Pension plan for your small business

Simplified Employee Pension IRA (SEP IRA) plans are employee IRAs funded by tax-deductible contributions from small business employers.